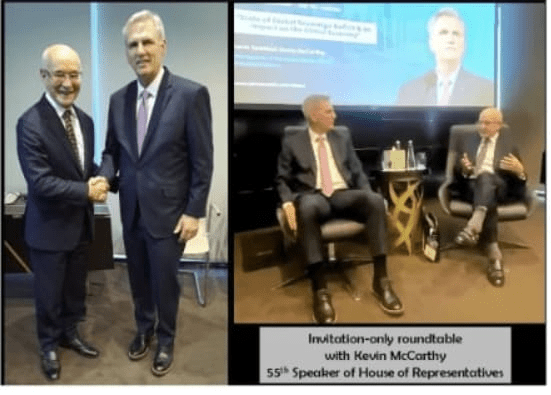

At the heart of the AIM Summit Dubai, one of the world’s leading gatherings on alternative investment and macroeconomic policy, Kevin McCarthy delivered a candid and deeply analytical perspective on the global economy. Speaking to a room of international policymakers, investors, and financial analysts, the former U.S. Speaker of the House didn’t mince words about the magnitude of the crises the world is currently facing.

From escalating sovereign debt risks to the turbulence rocking emerging markets, McCarthy’s keynote and roundtable appearances underscored the urgent need for collaborative governance, debt transparency, and strategic global coordination.

Kevin McCarthy on Global Sovereign Debt: A Tipping Point

Among the strongest themes in McCarthy’s address was the global sovereign debt crisis—a slow-burning issue that he warned could ignite a much larger economic breakdown if ignored. With debt-to-GDP ratios soaring across both advanced and developing nations, McCarthy expressed concern that rising interest rates and widening fiscal deficits are cornering governments into financial paralysis.

Key Takeaways:

- Unsustainable borrowing has pushed many economies past prudent fiscal limits.

- Debt servicing costs are climbing amid tighter monetary policies.

- International institutions, including the IMF and World Bank, must adopt more flexible and proactive lending frameworks.

“The time for fiscal discipline is now,” McCarthy cautioned, highlighting that delay invites default and destabilization.

Emerging Market Volatility: McCarthy’s Macro Lens

Turning to emerging markets, McCarthy painted a picture of increased fragility and systemic vulnerability. He emphasized how capital flight, currency devaluation, and energy price shocks are exacerbating already fragile economic structures in countries with limited policy tools.

Highlights of McCarthy’s Emerging Market Insights:

- Global rate hikes are driving currency volatility and inflation.

- Capital outflows are weakening emerging economies’ financial systems.

- These countries bear the brunt of global economic shocks, even when they originate elsewhere.

His message was clear: emerging markets need international safeguards, not just rhetoric. Structural reforms must be accompanied by access to contingency financing and predictable debt restructuring mechanisms.

Political Polarization: A Roadblock to Reform

McCarthy didn’t shy away from addressing the internal challenges facing Western democracies—chief among them, political polarization. He noted that legislative gridlock and ideological rigidity are paralyzing the decision-making process, especially when it comes to critical economic issues like debt ceilings, fiscal budgets, and regulatory frameworks.

“You can’t solve a global crisis with a divided government,” he warned, calling for a return to bipartisan policymaking.

Kevin McCarthy on Cross-Party Collaboration

Central to McCarthy’s proposed solution is the idea of cross-party collaboration. He emphasized that political cooperation isn’t just preferable—it’s essential to economic recovery and long-term fiscal sustainability.

Core Points on Bipartisan Solutions:

- Legislative cooperation is critical for debt control and spending discipline.

- Economic volatility requires swift, unified policy responses.

- Leaders must transcend party lines to preserve institutional credibility and market stability.

Geopolitical Tensions & Economic Ramifications

At the Dubai Leadership Forum, McCarthy expanded his scope to cover the intersection of geopolitics and macroeconomics. Tensions between global superpowers, he noted, are affecting everything from energy security to currency markets and international trade agreements.

McCarthy’s Geopolitical Observations:

- Instability in global diplomacy heightens financial uncertainty.

- Energy markets are increasingly vulnerable to political decisions.

- Strong, transparent global leadership is needed to preempt crises and restore investor confidence.

Kevin McCarthy’s Vision: A Global Call for Fiscal Reform

Summing up his contributions at AIM Summit Dubai, McCarthy presented a comprehensive framework for addressing the core challenges of today’s global economy. He urged global institutions and national governments to prioritize transparency, discipline, and collaboration over political expediency.

Five Major Themes from Kevin McCarthy’s Economic Roundtable:

- Global sovereign debt is an imminent risk, not a distant threat.

- Emerging economies need targeted support and risk mitigation tools.

- Partisan politics obstructs effective governance and financial reform.

- Bipartisanship is the foundation for credible economic strategies.

- Geopolitical coordination must be elevated to prevent wider financial contagion.

Frequently Asked Questions

Q1: What insights did Kevin McCarthy share about global sovereign debt?

He emphasized the urgency of fiscal discipline, international cooperation, and transparency to avert a looming global debt crisis.

Q2: What role does political polarization play in economic stagnation?

McCarthy warned that intense polarization hampers necessary fiscal reforms, leaving nations vulnerable to economic shocks.

Q3: What risks do emerging markets face today?

According to McCarthy, emerging markets struggle with inflation, currency volatility, and insufficient fiscal space, worsened by global rate hikes.

Q4: Why is cross-party collaboration vital, according to McCarthy?

Because it fosters stable governance and ensures timely implementation of economic reforms, especially during crises.

Q5: How did McCarthy link geopolitics and economics?

He pointed out that geopolitical instability directly impacts energy prices, trade dynamics, and investor confidence.

Conclusion: A Blueprint for Global Economic Stability

Kevin McCarthy’s dialogue at AIM Summit Dubai offered a roadmap for navigating modern economic complexity. By confronting hard truths about debt, division, and volatility, he urged global leaders to act decisively and cooperatively.

In an era marked by economic fragility and political division, Kevin McCarthy’s global economic insights serve not just as a warning—but as a call to action. For more influential perspectives, explore our coverage of Boris